Steve Levine, Ignite Consulting Partners

Our weekly tips, social media posts and articles for industry publications often point out behavior and actions that have gotten businesses in trouble. We focus on these events because they demonstrate actual risk and are great learning opportunities. Often, though, we get accused of using scare tactics and fear-mongering, usually by folks that haven't put forth the effort to protect their business and have a good reason to be afraid. We simply don't play upon fears, because we are confident in our belief that for those following the Ignite methodology, our tips and articles shouldn't be scary at all, and if our clients were faced with a similar situation they'd be able to demonstrate their commitment to compliance.

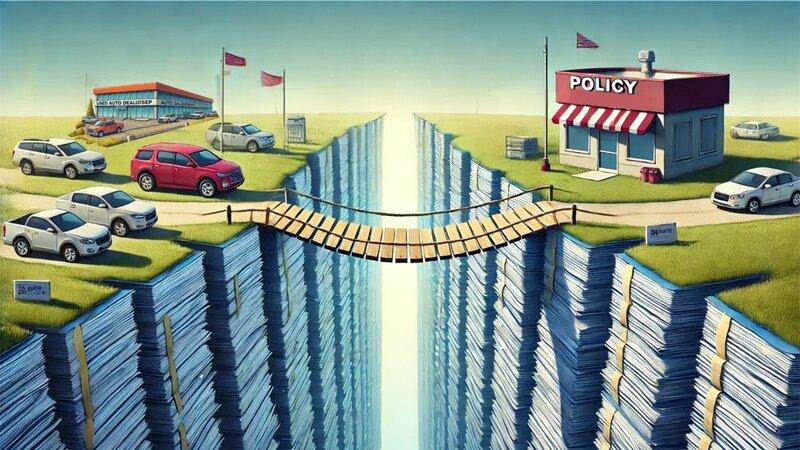

Recently a few situations came to our attention that reinforced why we have faith in our approach and best practices:

Repossession Process and Letters

A client was being examined by their state regulator and one of the items requested was copies of Notice of Intent to Sell or Strict Foreclosure letters. The finance company not only had strong letters, but had a policy, training materials, and written process for knowing when to use each letter. The examiner looked at the documentation, checked one file, and moved on to the next subject on their checklist. We just love it when examiners have no further questions.

Underwriting Doesn't Need to be Scary

A client was dealing with a complaint where the customer alleged that he was wrongfully denied credit. The client almost immediately provided the regulator a copy of its written underwriting policy and explained the credit decision with specificity, referencing points in the policy. The file was promptly closed. This is a great example of how having a good policy and actually taking time to implement it is worth its weight in gold.

Red Flags and Identity Theft

Lastly, a state examiner asked to see a client's "Red Flags" or "Identity Theft Prevention" Policy. Yes folks, examiners do actually ask to see these things. Once reviewed, the examiner had additional questions, and the client was able to supplement the policy with a process document and evidence that personnel were trained (consider this a plug for Training Unleashed). The take-away here is that sometimes having a policy isn't enough, the regulator wants proof that it has been implemented. As we've been known to say "the only thing worse than having no policy is having one but having operational practices that contradict the policy". Again, think how different the examination could have gone if there was no content to provide.

Conclusions

Like we said at the outset, whether anecdotes like this are scary or not is up to you. They aren't scary if you are putting in the work. If you're not.....well......be afraid, be very afraid.

Put in the work, it's that simple. We can anticipate the areas that present the greatest risk, we know what dealers get sued for, and we know the stones that regulators like to turn over. So take advantage of our knowledge and sleep better at night.